Ready to get started with Seylan Personal Online Banking?

Self Registration

You can now register for Internet banking by yourself at the comfort of your home.

Strong and Secure

Your accounts are now safe and confidential with Seylan Internet Banking. You can now secure your accounts using the multi-factor authentication.

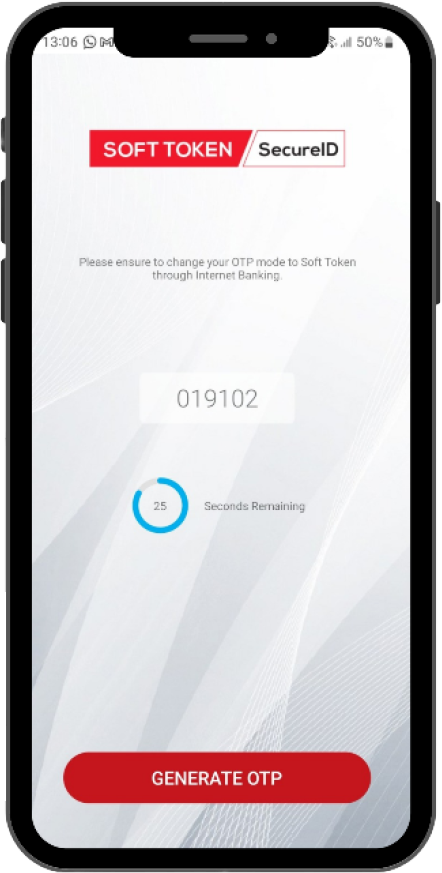

Generate Secure OTP via Seylan Soft Token

Securely generate your own OTP with the Seylan Soft Token App to perform Online and Mobile Banking transactions where ever you are, reducing the risks associated with SMS OTP and email OTP. For more details click here.

Self-Password Reset

You can now reset your password by your own without having to visit the bank.

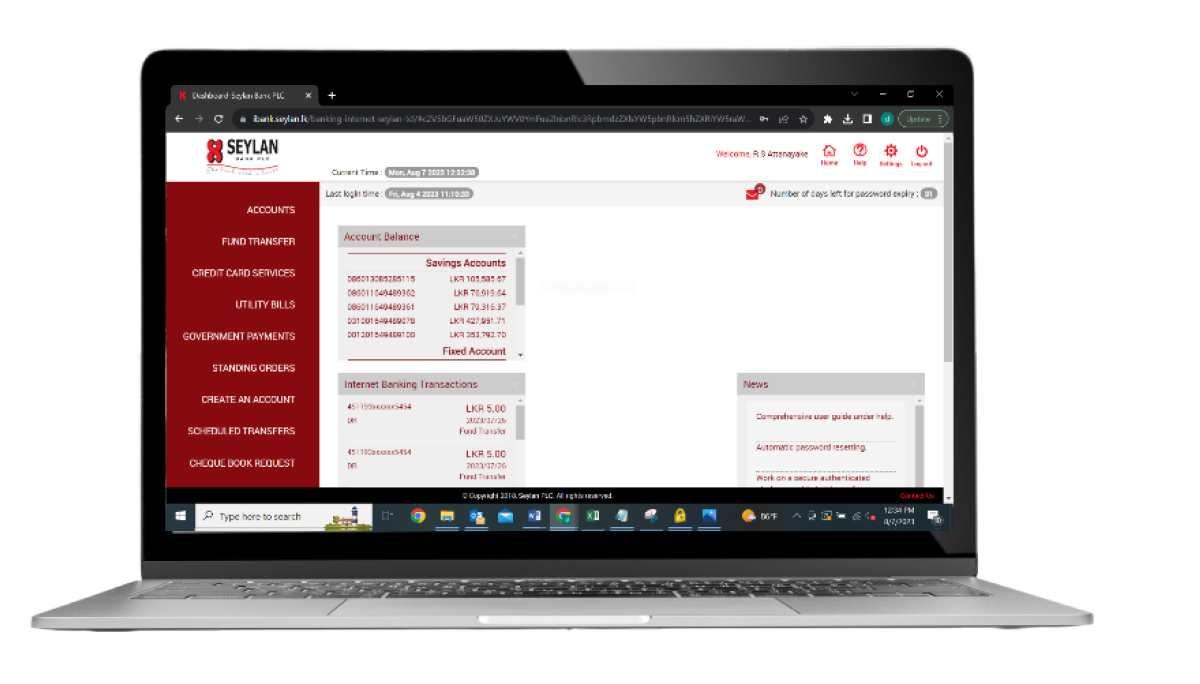

Current & Savings Accounts

Manage all your Savings Accounts and Current Accounts registered under your NIC number.

Fund Transfer

Carry out Fund transfers across Seylan accounts and other bank accounts.

Bill Payments

Easily pay your utility bills ranging from communication, water, electricity, transportation, insurance, etc.

.png)

Credit Card Services

Using your Seylan credit Cards you can now carry out bill payments, settle payments, cash advances and request statements for your credit cards.

Open Fixed Deposits & Savings Accounts

Conveniently open new Fixed Deposits and Savings Accounts on your own with Seylan Online banking.

Loan Against Fixed Deposit

Easily obtain a loan against your Fixed Deposit without visiting the branch. Enjoy a hassle-free process with flexible repayment options - all through Seylan Online Banking. Click here for user guide.

Get Started

Here’s what you’ll need to register

- Your account number – Savings or Current

- Fixed Deposit or

- Credit Card (Primary)

- Update your Mobile Number and Mail Address with the bank

Once you are ready to register simply follow our handy step-by-step guide for Seylan Online Banking Self Registration.

Do not forget:

- To read the “Terms and conditions” for internet banking.

- Ensure all the information provided by you are accurate.

- Update your phone number with the bank to experience better service.

- Whenever you are not accessing your accounts “DO NOT” divulge the password to anyone.

FAQ

- What are the registration charges?

Joining fee is free of charge.

- What are the charges for transactions?

Free fund transfers - within bank transfers free of charge and fund transfers to other bank accounts is Rs.25 per transaction

Utility bill payments - free of charge

Credit Card payments – Seylan Credit card free of charge & Other Bank credit card payments Rs.25 per transaction

- Who do I contact for help?

Call us on 011 200 8888 or mail us at info@seylan.lk

-

Soft Token Mobile App

Seylan Online Banking Soft Token is an application that generates a "One Time Password (OTP)" to perform transactions via Online banking and Mobile Banking.

This app will eliminate the process of waiting for a ONE-TIME PASSWORD usually sent via SMS.

This service also works offline hence you don’t need to have an active data service on your phone therefore saving time and money when overseas.

Seylan Soft Token App is available for all iOS and Android devices and can be found on the respective app stores.

How to register for Soft Token?

Benefits of Seylan Online banking Soft Token?

- You can avoid any delays or accessibility via SMS

- It also works when you are overseas on offline (no data) mode

- Eliminates the hassle of activating Roaming as this app works without network coverage

- Ability to switch from Soft Token to SMS OTP

When to use the Soft Token Application to generate an OTP?

- At the time when creating new fund transfer beneficiary

- When making Ad-Hoc Fund Transfers & bill payments

- Placing standing orders

- When creating Sri Lanka Customs payments