Seylan Visa Signature Credit Card Step into a world of offers, privileges and experiences at ease with your Seylan Visa Signature Credit Card

- 100% OFF ON THE FIRST YEAR ANNUAL FEE AND 50% OFF ON THE JOINING FEE

Enjoy amazing offers & benefits with 50% off on the joining fee and the first year annual fee waived off.

Enjoy Lounge key access to over 1100 lounges worldwide. Cardholder’s first lounge visit for the year will be complimentary.

30 Days free Travel Insurance when you purchase the return air ticket with your Seylan Visa Signature Credit Card.

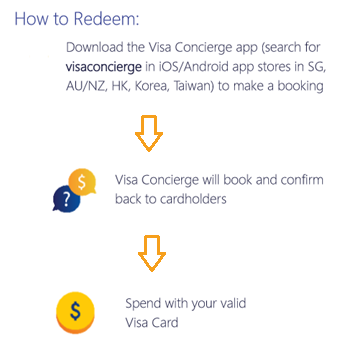

Receive an array of privileges at the best restaurants around the world, when booked via the Visa Concierge App.

Receive assistance in travel, entertainment & experiences, special services, and gift purchases through the toll-free contact number. Click here to login to VISA CONCIERGE.

Contactless payments let you pay without swiping or dipping your card. Payment cards enabled with this contactless payment has the contactless mark on the card face

- TRAVEL EXPERIENCE

Enjoy a range of hotel offers and travel car hire offers across the globe from selected merchants.

- AIRPORT EXPERIENCE

Enjoy offers on the Visa Airport Limo transfer program, Airport Meet & Greet, and Lounge access.

- 800+ OFFERS WORLDWIDE

Enjoy the finest deals with over 800+ merchants worldwide. Be it clothing, dining, electronics, accessories, education, health, online or holiday offers, Seylan Bank has got you covered.

- DINING

Dining-Complimentary main course at selected restaurant locations worldwide.

- CARDS REWARDS POINTS ON PURCHASE TRANSACTIONS

Enjoy Rewards points for locally / Overseas spent. Transactions of more than LKR 1000 will be eligible. Visit Seylan Credit Card Reward Program to enroll & for more details.

- INSTALMENT PLAN FACILITIES

Manage your credit card payments with convenience using installment plan facilities.

- CASH ADVANCE

Obtain cash withdrawals up to 50% of your available credit limit.

- SMS ALERTS

Free SMS alerts on your Credit Card transactions to the registered mobile number.

- SEYLAN E-STATEMENTS

Seylan e-statements are provided with password protection. You will receive a consolidated e-statement.

- EXPRESS CASH LOAN

Obtain an express cash loan up to 75% of the credit limit and settle in equal monthly installments up to 60 months.

- Enjoy wide range of card Deals & Promotions.

Eligibility

- Age Between 18 – 65

- Salaried – Net Income > LKR 300,000.00 per month

- Self-employed – Average credit turn over > LKR 2.5Mn per month

Overseas spend thresholds

Foreign spend/ cash thresholds are subject to country risk evaluation, hence certain countries may have restricted spend/ cash limits.

Credit Limit, Interest Rate & Fees

| Description | Amount(LKR)/ Details/ Rates |

|---|---|

| Credit Limit | LKR 1,000,000.00 and above |

| Cash Advance Limit | 50% of the Credit Limit |

| Interest Rate %p.a. | 26.00% p.a.- w.e.f. 07 Sep 2024 |

| Annual Fee* | LKR 6,000.00 |

| Joining Fee* | LKR 2,750.00 |

| Supplementary Card Fee | LKR 3,000.00 |

| Interest Free days on Purchases (maximum) |

51 Days (Interest free days are applicable only when full settlement is made monthly and is not applicable for cash advances). |

| Late Payment Fee | LKR 2,000.00 (w.e.f. 01 Mar 2024) |

| Over Limit Fee | LKR 1,750.00 (w.e.f. 01 Mar 2024) |

| Cash Advance Fee | LKR 700.00 or 4.00% whichever is higher |

| Pin Re-Issue Fee | FREE |

| Handling Fee - Paper Statement | FREE |

| Statement Copy Fee | FREE |

| Confirmation Letter issuing fee | FREE |

| Voucher Copy Retrieval Fee | FREE |

| Cheque Return - Refer to Drawer | FREE |

| Cheque Return - Other Reasons | FREE |

| Lost Card Replacement Fee | FREE |

| Overseas Courier Fee | LKR 4,000.00 |

| Limit Enhancement Fee | FREE |

| Travel Insurance Fee (per Policy) - up to 30 days | FREE |

| SMS Alert Fee ( Per Annum) | FREE |

| Fuel Surcharge | 1% |

| Overseas Transactions |

All overseas transactions will be converted using VISA International exchange rates. In order to mitigate local exchange rate movements, an additional amount (minimum of 4.50%**) will be included to the rate at the time of billing. ** Rates are subjected to market rate fluctuations. |

| Processing Fee |

In order to mitigate the risk of exchange rate variances, all Card transactions done at overseas merchants/service providers and websites registered outside of Sri Lanka but billed in Sri Lankan Rupees (LKR) in the form of Dynamic Currency Conversion or Multi-Currency Transactions will attract a Processing Fee of minimum 3.5%** on the LKR transaction value. ** Rates are subjected to market rate fluctuations. |

| Cancellation Letter Issuance Fee | LKR 2,000.00 |

| Easy Payment Plan Early Settlement Fee | 4% from the remaining balance. |

| Urgent Application Processing Fee | LKR 1,500.00 |

|

Processing Fee on 0% Easy Payment Plans |

LKR 2,000.00 (w.e.f. 01 Mar 2024) |

| Branch Over the Counter Withdrawal Fee | LKR 2,000.00 Handling Fee + 4% on the withdrawal amount (W.E.F 7th Oct 2024) |

| Cancellation Fees (T&C apply) | LKR 3,000.00 |

** First Year Annual Fee will be waived off as an introductory offer.

***Joining Fee is 50% waived off as a promotional offer.

How to get started

- Call our dedicated Premier Hotline +94112008877

- Submit a Call back request.

- Visit Any Seylan Branch Island wide.

Or

Against a Fixed Deposit as Security, with 90% of you deposit value as your Credit Card Limit.

Modes of Credit Card Payment

| Modes of Payment | Payment Cut-Off Time | Payment Updating TIme |

|---|---|---|

| Payments through Seylan Internet Banking or Seylan Mobile Banking Application. | 3.00 PM | Real Time |

| CEFTs transfers from a current or saving account through CEFTs enabled banks’ Internet Banking or Mobile Banking Application. | ||

| Cash deposits at any Seylan Cash Deposit Machine. | ||

| Cash Deposit at any Seylan Bank Branch counter. | Branch Closing Time | |

| Cheque Deposits at any Seylan Bank Branch. | 1.00 PM | Same day if it is a Seylan Bank cheque or else upon realization. |

| Automatic transfer instruction from Seylan Savings or Current Account (Direct Debit/Standing Instruction) | N/A | Same Day ( when the Direct Debit / Standing Instruction is effected) |

Interest Calculation

- No Interest will be levied (except on cash advances) if full payment is made on or before the due date. You will enjoy up to 51 days free of interest (depending on the transaction date), provided the previous months total outstanding is paid by due date in full.

- If full payment is not settled on or before the due date, interest will be calculated from respective transaction dates up to the billing date on reducing balance basis

- Interest/finance charges will be charged if full payment is made after the due date

- Interest will not be charged for purchases billed in current month but will be charged on the following month (from the transaction date) if not settled in full by the due date

- Interest to a particular transaction will be charged from the transaction date on the following month and there onward from the billing date, if rolled over.

- Payments are first applied to charges and then to purchase and cash advances on first in first out basis

- Cash advances will accrue interest from the date of transaction until it is paid in full.

- Sample Interest calculation

Loss of cards should be reported immediately to Seylan Call Centre on 24 hour dedicated Premier hotline +94 112008877 and follow up with a letter. The cardholder will not be liable for any transactions performed subsequent to informing the loss of the card to the bank.

It will take a minimum of 7 working days and maximum of 10 working days once the relevant documents are handed to the Branch/ Sales officer/Card Centre.

Minimum Payment = 3% of statement balance + overdue and over limit amount (if any)

If the customer fails to pay the minimum payment on or before the due date the late payment fee will be charged.

If the customer exceeds the approved credit limit at any at any given date of the particular billing cycle, an over limit fee will be charged.

Terms and Conditions

- No refund of Annual Fees will be made if the card is terminated or not accepted.

- No Financial Charges will be levied (except on Cash Advance) if full settlement is made monthly on or before due date.

- Additional expenses, such as legal fees, credit transfers, cheque issuance and overseas charges (e.g. courier, fax, postage etc.) will be levied where incurred.

- Secure Card (against Fixed Deposits) will be issued “First Year Free” and will attract “Lower” Interest rate.

- LKR 25.00 will be charged for every LKR 1,000 spent on foreign transactions (Government Stamp Duty).

- The Bank reserves the right to change the above rates at any time with prior notice.

Seylan member?

Seylan member? Find a Branch

Find a Branch Call us

Call us Apply for a Card

Apply for a Card